Terminating an employee in Xero can seem tricky if you don’t know the steps.

Missing key details or getting something wrong could lead to compliance issues and payroll headaches.

But don’t worry – this guide will walk you through every step of the process, ensuring a smooth and accurate employee termination in Xero.

NOTE: Before we start, it’s important to note that you’ll need payroll admin access in Xero to terminate an employee. Without it, you won’t be able to access the payroll tab, which is where everything will happen. If you don’t have access, contact the manager responsible for the Xero file to get the necessary permissions.

Step 1: Approve / Reject Any Pending Leave Request

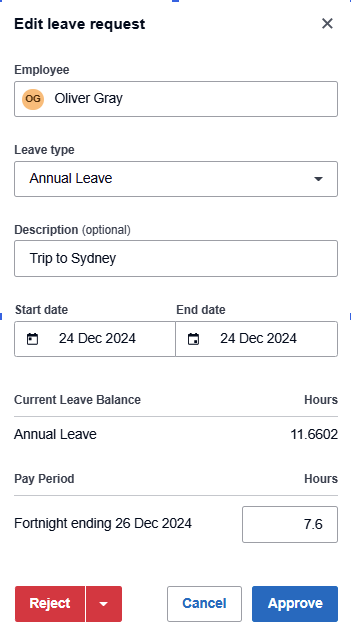

You first need to deal with any existing leave requests for this employee. For any leave requests they have submitted that relate to a date BEFORE their termination date, ensure these have been approved. For any leave requests submitted for leave that will occur at a point in time AFTER their termination date, you will need to Reject these before you can proceed with the termination.

To manage leave requests as a Payroll Admin:

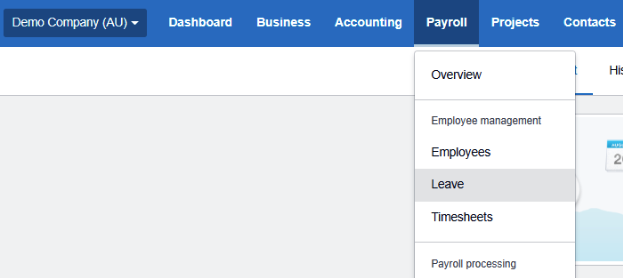

- Go to the “Payroll” tab in Xero.

- Select “Leave” to view all pending leave requests.

- Review each request, checking leave balances and any notes provided.

- If you’re approving this request, Click “Approve”

- If you’re rejecting this request, click the 3 dots menu icon and select “Reject”

- Once approved or rejected, the request status updates automatically.

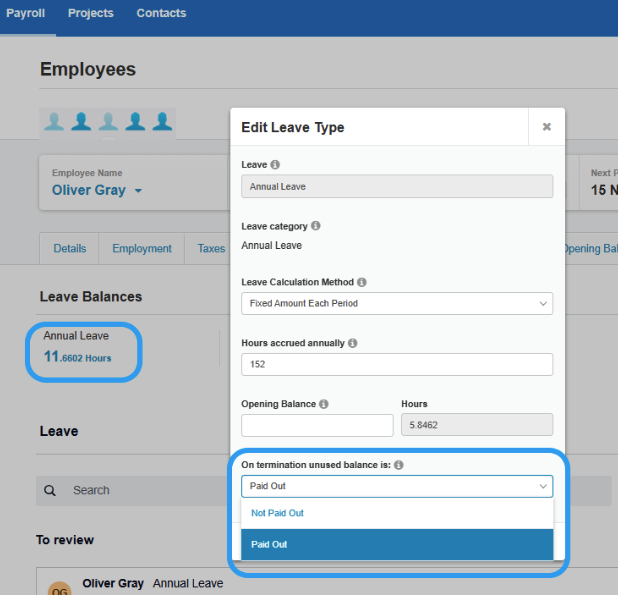

Step 2: Review Leave Pay-Out Instructions

Before you process the final pay for an employee termination, you need to ensure any unpaid annual leave is set to “paid out” and any personal (sick/carer’s) leave is set to “not paid out”. This will ensure the amounts owing will show on their final payslip.

The process is the same for both types of leave. Here’s how to do it:

- Go to the “Payroll” tab in Xero and click “Employees”.

- Select the employee’s profile.

- Click on the “Leave” tab and select the relevant leave type (e.g. annual leave).

- Under “On termination unused balance is”, select “Paid Out”.

- Follow the same process for personal (sick/carer’s) leave but instead choose the option “Not Paid Out”.

NOTE: Personal (Sick/Carer’s) Leave generally isn’t paid out unless you have specific agreements with the employee or the award requires it. Always check your award or contract terms to be sure.

If your employee has worked for you for less than 5 years there will be no Long Service Leave payout. If your employee has worked for you for more than 5 years you may be liable to pay out an amount of Long Service Leave. Please check with your bookkeeper or accountant as to whether this applies to the employee you are terminating.

For employers in the Building and Construction Industry please ensure you are aware of your responsibilities relating to Entitlements. Again, you may need your bookkeeper or accountant to assist you with this process.

Step 3: Process Final Pay for a Termination

You will now process the employee’s final pay.

This ensures all wages, leave, and entitlements are calculated accurately, follow these steps below:

- Go to the “Payroll” menu and select “Pay Employees.”

- Add a new “pay run” and select the pay run that the termination applies to.

- Select the employee’s name to open their payslip.

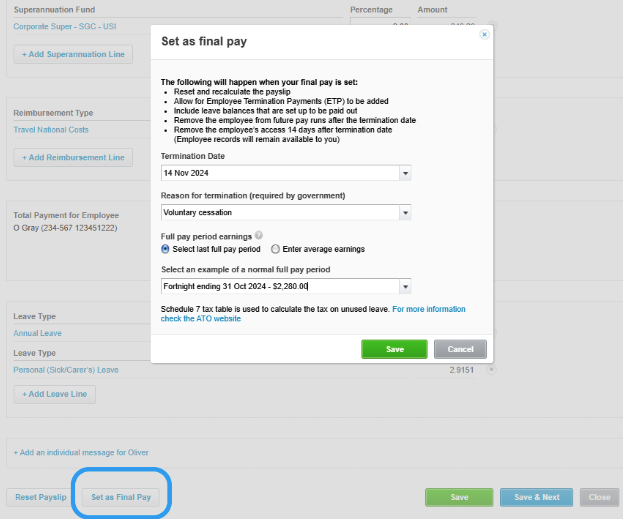

- Click “Set as Final Pay” at the bottom of the payslip.

- Enter the termination date and choose the reason for termination (For an employee who has resigned select “voluntary cessation”).

- Under “Full pay period earnings”, select one of the following options to calculate the tax on unused leave:

- Select “last full pay period”: Select an example of a normal full pay period from the dropdown menu below. This is the most common option used.

- Enter average earnings: In the field below, enter the employee’s average earnings if they work irregular hours.

- Click Save to finalise.

- (Optional) Add a pay item for an ETP.

- (Optional) Adjust a lump sum A or B payment.

- Review the employee’s payslip, including:

- Outstanding wages for hours worked in the relevant pay period

- Accumulated leave for the final pay adjustmen

- Tax on unused leave included in the final pay

- Tax on an ETP (if applicable)

- Click Save, then click Close.

- On posting of this pay run the employee will automatically be terminated in Xero. You can find their payroll record by going to Payroll > Employees > and selecting the “Past” tab.

NOTE: Depending on the reason for termination, there may be additional payouts required beyond what we’ve discussed here. These could depend on agreements with the employee or awards they’re covered under. Be sure to check with your bookkeeper or accountant if you’re not sure.

Step 4: Finalise ATO Reporting

To ensure compliance, you must report the employee’s termination to the ATO:

- Go to the “Single Touch Payroll” (STP) section in Xero.

- Select the relevant pay run that includes the employee’s final pay.

- Check the box for “Final Pay” in the employee’s record within STP to notify the ATO of their termination.

- Submit the STP report to finalise the process with the ATO.

This step ensures that the ATO is informed about the employee’s termination and that your records remain compliant with tax obligations.

Please note that the superannuation payable on your employee’s final pay has the same reporting deadlines as that of your other employees. Some employers may prefer to process and pay superannuation at the same time as the termination payment.

What am I required to pay out on termination?

When terminating an employee, final pay must include all outstanding wages, unused leave, and any other entitlements like redundancy payments.

The employee’s final pay is typically due on their last working day or the next scheduled payday, depending on the award or agreement.

Employers must also provide the correct notice period or payment in lieu. For more detailed information on what to include in final pay, check the Fair Work website.

What’s next?

Terminating an employee in Xero doesn’t have to be complicated. By following these simple steps, you can ensure the process is handled smoothly and in compliance with ATO requirements.

If you need extra support in completing the process above, Heart Bookkeeping offers online Xero training & UNLIMITED support, to give you the confidence to handle your books without any hassle.

If you’d like to learn more about our ongoing bookkeeping services, schedule a free discovery call today, and let’s make managing your business finances easier together!